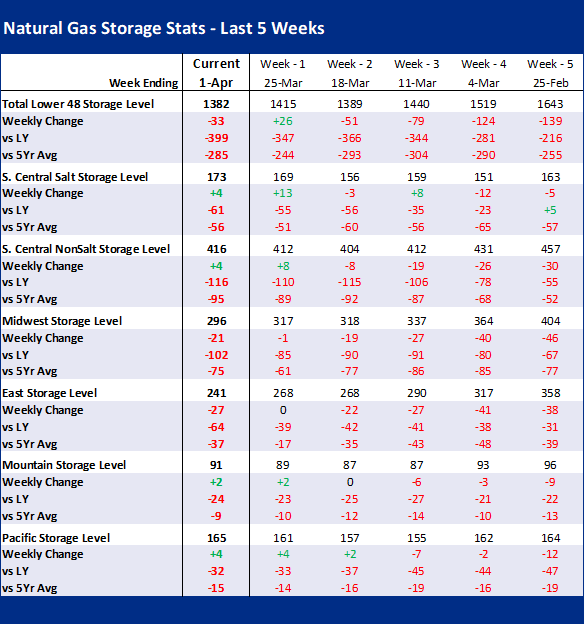

Yesterday, the EIA reported a -33 Bcf draw for the week ending Apr 1, which came in higher than market estimates. We estimate this report was +0.2 Bcf/d tight vs LY (wx adjusted). This past week’s stronger than expected draw comes with cool temps across the East Coast and Midwest that led to strong draws in those regions. Meanwhile, all other regions experienced a small injections.

With this final report, we have a final tally on this past winter’s storage activity. Storage levels ended this winter with 1382 Bcf left in the ground. This level is 399 Bcf less than last year at this time and 285 Bcf below the five-year average of 1,667 Bcf

We had been expecting a 1300 EOS back in Nov, but that quickly inflated to 1600+ with the warm Dec before dropping back this tight level.

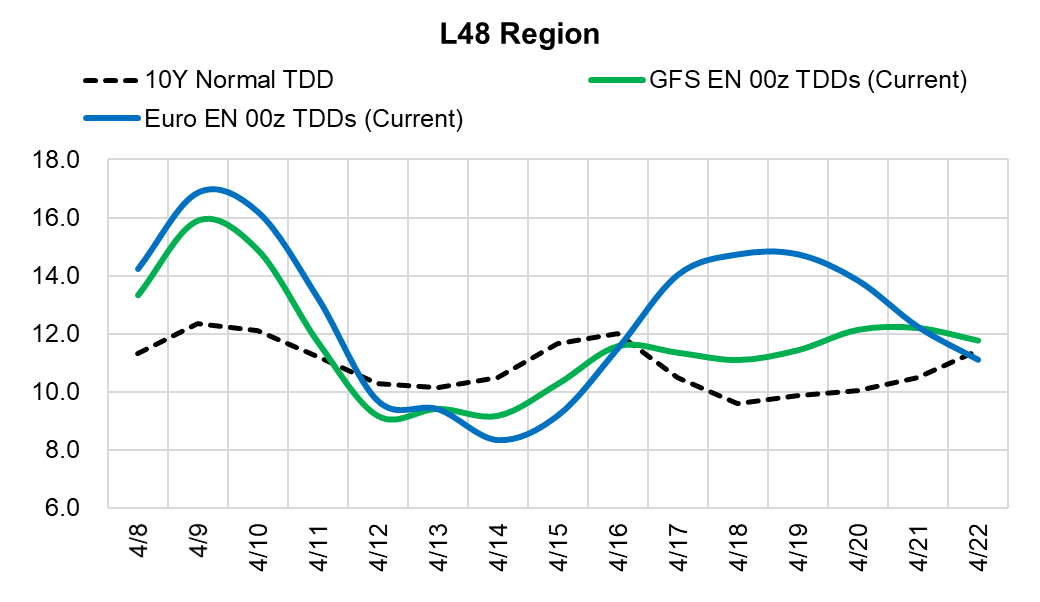

For the next report and beyond we are back into injection territory. A strong warm-up will occur early to mid-next week as temperatures soar well above normal for a few days, then the next cold front will arrive by Friday in the Midwest and over the Easter weekend in the East and South.

Today’s Fundamentals

Daily US natural gas production is estimated to be 95.9 Bcf/d this morning. Today’s estimated production is +0.63 Bcf/d to yesterday, and -0.19 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 83.3 Bcf today, +0.66 Bcf/d to yesterday, and +3.29 Bcf/d to the 7D average. US power burns are expected to be 27.5 Bcf today, and US ResComm usage is expected to be 25.1 Bcf.

Net LNG deliveries are expected to be 12.8 Bcf today.

Mexican exports are expected to be 6.9 Bcf today, and net Canadian imports are expected to be 5.6 Bcf today.

The storage outlook for the upcoming report is +26 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.