PDF Attached

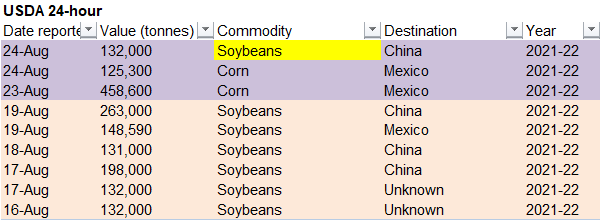

Correction to our 24-hour table. We had China buying corn but they bought soybeans. Text revised as well.

WASHINGTON, August 24, 2021—Private exporters reported to the U.S. Department of Agriculture the follow activity:

Export sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year; and

Export sales of 125,300 metric tons of corn for delivery to Mexico during the 2021/2022 marketing year.

WORLD WEATHER INC.

MOST IMPORTANT WEATHER OF THE DAY

- Texas cotton, sorghum and corn production areas may become vulnerable to a tropical cyclone early next week

- A developing storm off the east coast of Honduras and Nicaragua later this week will move across the Yucatan Peninsula Friday before moving across the Gulf of Mexico

- Landfall is ultimately expected in a part of Texas early next week

- If the landfall occurs as expected there will be a big interest in cotton, corn and sorghum impacts and the storm will be closely monitored

- Harvesting of cotton is already far advanced in South Texas, but it is just beginning in Coastal Bend with many bolls open

- U.S. Midwest will experience sufficient rainfall over the next two weeks to minimize the potential for serious dryness issues

- Significant rain will fall in the north to stop any concern of expanding dryness in that region

- Southwestern parts of the Corn and Soybean Belt will experience net drying for up to ten days and that could bring on a rising in crop stress

- Some of this drying might also occur farther east into the lower Midwest for a little while

- Favorable subsoil moisture in these areas should carry crops into the drier period, but rain advertised for the latter part of next week will prove to be very important in slowing or halting the expansion of dryness and crop stress

- Canada’s Prairies continue to receive periodic rainfall and relief from dryness has been and will continue to occur in many areas

- The drought is not over, but the rain is benefiting late season crops

- Some harvest delay has been and will continue to occur for a while, but producers in the Prairies are mostly going to be happy to get relief from the drought

- Northwestern U.S. Plains drought relief is expected to be more limited than other areas in the Canada Prairies and eastern Northern Plains

- Rain is needed, although dry weather has been good for crop maturation and harvest progress

- U.S. Delta and southeastern states will see a good mix of weather over the next ten days supporting normal crop development

- West Texas cotton, corn and sorghum areas could receive rain next week from a tropical weather system

- The moisture might be good for long term moisture in the soil, but not necessarily the best feature for getting the current crop to mature faster

- Degree day accumulations are a little low and late planting in dryland production areas has some of the crop 2-3 weeks behind the usual development

- Far western U.S. weather will remain dry for the next two weeks.

- Argentina’s weather is not as wet today as that suggested Monday in days 11-15; otherwise, dry biased conditions are expected until that time

- Brazil rain is expected to evolve in the south over the next few days

- Some of this moisture will reach into northern Parana and Sao Paulo Thursday into Saturday bringing some moisture to wheat, coffee and some minor sugarcane areas

- The moisture in coffee and sugarcane areas will help induce some improvement in freeze damaged crops

- Showers will reach farther north into Brazil coffee areas Sunday into next week, but the impact on crops should be mostly good

- Rainfall should not be enough to bolster soil moisture enough to induce flowering, but the moisture may help improve leaf development after July freezes

- Northeastern New South Wales, Australia received significant rain Monday and overnight resulting in a welcome boost in topsoil moisture ahead of reproduction in September

- Queensland, Australia received only light showers Monday and resulting rainfall may have been a little disappointing

- There is potential for more rain coming next week and if the forecast verifies that moisture will be extremely well timed ahead of wheat and barley reproduction

- Confidence is low, however

- Northwestern India is still projected to be dry biased during the coming week to ten days

- The GFS forecast model does bring showers into the dry region in the second half of next week, but confidence is low

- Most of India’s summer crop development this year has been very good and production is expected to be high in most areas outside of the unirrigated areas in the northwest

- Pakistan’s irrigated summer crops have likely performed well, but rain would have been welcome this year

- Warm to hot temperatures most of the summer may have stressed cotton enough to reduce some of its boll sizes and quality

- China reported localized pockets of heavy rainfall once again Monday and early today, but no widespread excessive rain event was noted

- Rainfall this month has been greater than desired for many crops in the nation and that could have some impact on production

- A part of northeastern China’s small grain crop is probably too wet and may be suffering a quality decline, but corn, soybeans, rice, sugarbeets and other crops are likely in favorable condition

- China needs to dry down, but is unlikely to do so for a while

- Western Europe will be dry for the next ten days

- The drier weather may stress a few late season crops in France and the U.K., but it will be good for fieldwork and for expediting early season crop maturation

- France and the U.K. will be driest, but some areas in Germany, Belgium, Netherlands, Denmark and Norway will also be impacted

- Eastern Europe will experience frequent rainfall and milder than usual temperatures over the next ten days

- Some rain will fall in the Balkan Countries where dryness has been a threat to unirrigated summer crop production in recent weeks

- Russia’s New Lands and Kazakhstan have been drier biased this month.

- Crop conditions have been favorable except in and north of Kazakhstan where too much heat and dryness hurt wheat and sunseed production

- Western Russia summer crop conditions have been good and little change is expected

- Harvesting 2021 crops and the planting of 2022 crops is occurring, but a little slower than desired in some of the wetter areas in western and northern Russia and neighboring areas.

- A new tropical disturbance is expected in the Caribbean Sea late this week off the coasts of Nicaragua and Honduras that may move across the Yucatan Peninsula as a tropical depression or storm Friday

- The storm will then move to the Texas Coast early next week

- Heavy rain, strong wind speeds and flooding may impact areas from South Texas to Houston area of Texas and then inland across much of Texas

- Southeast Asia crop areas will receive periodic showers and thunderstorms over the next two weeks

- West-central Africa rainfall over the next ten days will be sufficient to support most crops

- Coffee, cocoa, rice, sugarcane and cotton development has been and will continue to be good this year

- East-central Africa showers and thunderstorms have been and will continue to be timely and beneficial resulting in a good outlook for coffee, cocoa, rice, sugarcane and other crops that are produced from Ethiopia into Uganda and southwestern Kenya.

- Showers in South Africa will be erratic and light most of this week

- The precipitation will benefit many wheat, barley and canola crops

- Southern Oscillation Index was +3.42 Sunday and the index should move in a narrow range over the next week to ten days with some upward movement

- Mexico rainfall will be more limited for a while this week – at least in the interior two-thirds of the nation

- Rain will fall heavily in some eastern and western coastal areas

- A new tropical cyclone will threaten Tamaulipas early next week, although the storm may move into Texas and leave Mexico out of its significant rain and wind

- Central America rainfall will be routine and sufficient to maintain a very good outlook for all crops in the region from Panama to Guatemala

Source: World Weather Inc.

Tuesday, Aug. 24:

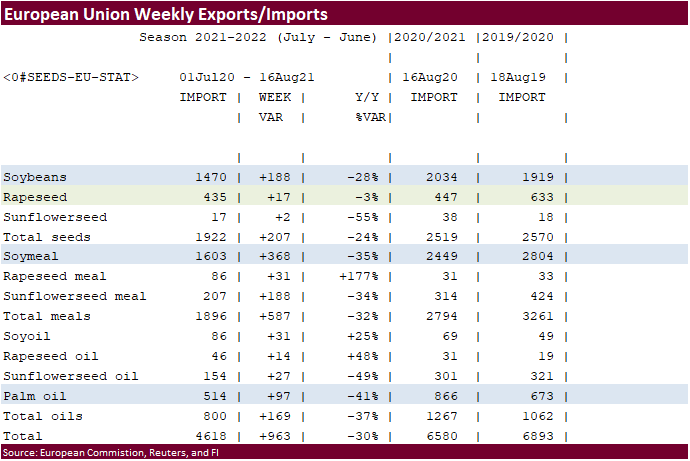

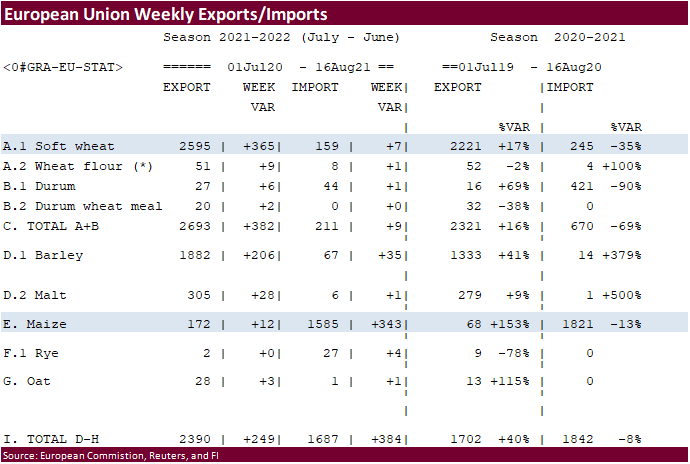

- EU weekly grain, oilseed import and export data

- U.S. poultry slaughter

Wednesday, Aug. 25:

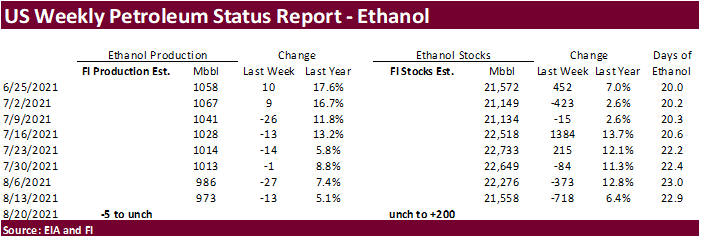

- EIA weekly U.S. ethanol inventories, production

- Malaysia Aug. 1-25 palm oil export data

- Unica cane crush, sugar production (tentative)

Thursday, Aug. 26:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- International Grains Council monthly report

- Port of Rouen data on French grain exports

Friday, Aug. 27:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

Source: Bloomberg and FI

77 Counterparties Take $1129.737 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1135.697 Bln, 76 Bidders)

US New Home Sales Jul: 708K (est 697K; prev R 701K)

– New Home Sales (M/M): 1.0% (est 3.1%; prev -6.6%)

US Philadelphia Fed Non-Manufacturing Regional Business Activity Index Aug: 39.1 (prev 53.8)

Philadelphia Fed Non-Manufacturing Full-Time Employment Index Aug: 8.2 (prev 24.8)

Philadelphia Fed Wage And Benefit Cost Index Aug: 43.0 (prev 50.2)

Philadelphia Fed Non-Manufacturing New Orders Index Aug: 27.4 (prev 31.8)

Philadelphia Fed Non-Manufacturing Firm-Level Business Activity Index Aug: 37.2 (prev 44.8)

Canada Factory Sales Fell 1.2% In July- StatsCan Flash Estimate

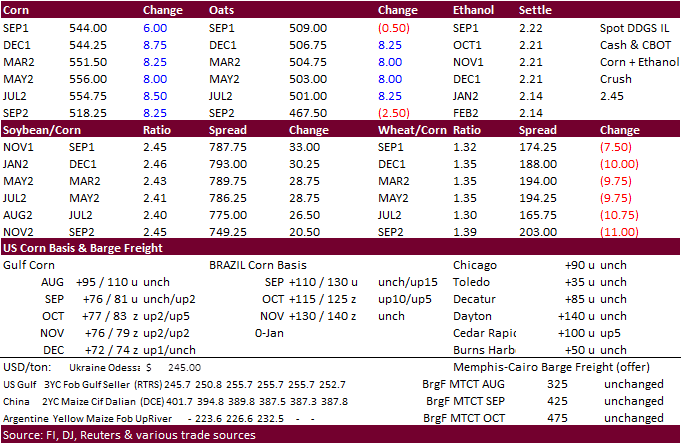

- Corn futures ended higher on USDA 24-hour sales, a drop in US crop conditions, and higher soybeans.

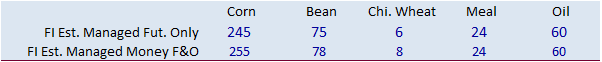

- Funds bought an estimated net 9,000 corn contracts.

- We updated our US corn balance to reflect some demand changes to 2020-21 and updated yield/production for new-crop. We took 2020-21 corn for ethanol down to 5.056 billion from 5.060 previous due to the rapid decline in weekly ethanol production. Our exports were lowered from 2.80 billion to 2.76 billion from slowing export inspections and feed was raised 50 million to 5.750 billion. We lowered our US corn yield from 174.5 to 173.6/bu per acre. Production is estimated at 14.794 billion.

- China plans to soon release guidelines on commodity price index regulation. They are seeking public comment through September 6.

- A Bloomberg poll looks for weekly US ethanol production to be up 2,000 barrels (962-986 range) from the previous week and stocks down 39,000 barrels to 21,519 million.

Export developments.

- Results awaited: Qatar seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

- Under the 24-hour announcement system, private exporters sold of corn to Mexico for 2021-22 delivery.

Updated 8/20/21

September corn is seen is a $5.20-$5.60 range.

December corn is seen in a $4.75-$6.00 range

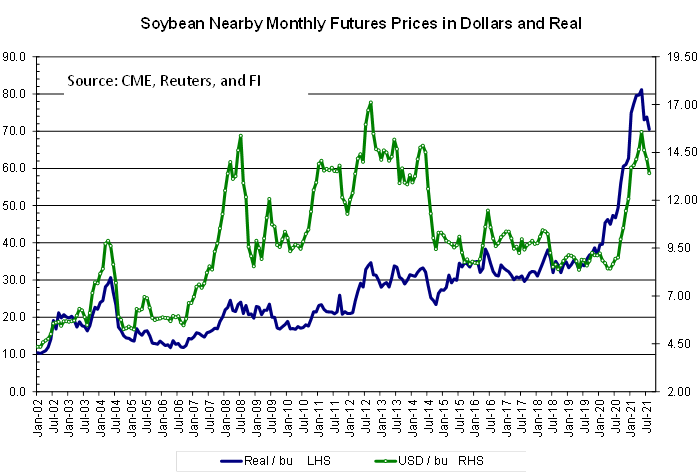

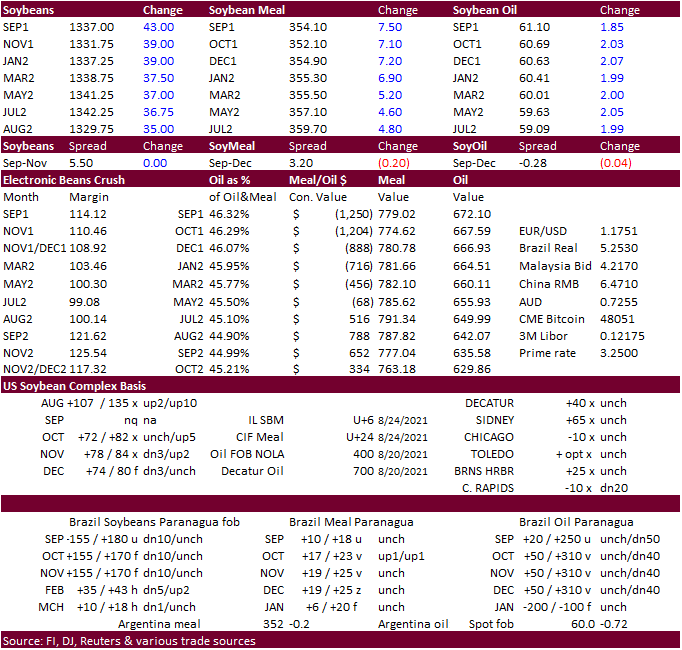

· US soybean complex ended sharply higher on speculation US demand for soybeans and products have or will soon increase in coming weeks. The decline in US crop conditions kicked off buying in soybeans followed by technical buying. Early this morning we heard China bought a couple cargoes of PNW soybeans at $3.25 over the November for October shipment. Then later they bought 8 cargos US beans this week, 4 out of the PNW (maybe higher) and 4 out of the Gulf. The spread between the PNW and Gulf narrowed to near par. One source said Sinograin was replenishing reserves.

· Funds bought an estimated net 17,000 soybeans, 5,000 meal and 7,000 soybean oil.

· China’s Sinograin sold 294,892 tons of 2019 imported soybeans out of reserves, all that was offered, at an average price of 4,444 yuan per ton ($686MT).

· The soybean products traded sharply higher led by another rally in soybean oil in part to higher WTI crude oil and hopes India may buy US soybean oil. Soybean meal surged mid-morning on talk of India allowing imports of GM soybean meal, firming US cash basis, US crush plant maintenance shutdowns, and oversold conditions.

· IL soybean meal basis firmed $3/short ton to 12 over the September.

· Trader are looking for India to increase vegetable oil imports ahead of their new-crop season which starts in November after they lowered import taxes on crude soybean oil and crude sunflower oil.

· India’s government relaxed on their rules for imports of GM soybean meal. We are hearing up to 1.2 million tons will be allowed. https://pib.gov.in/PressReleseDetail.aspx?PRID=1748658

· The Southern Peninsula Palm Oil Millers’ Association forecast an 11.5% month-on-month rise in Aug. 1-20 production.

· Argentine sold 27.9 million tons of soybeans for the 2020-21 season through Aug. 18, below 29.9 million tons year ago.

Export Developments

- Under the 24-hour announcement system, private exporters sold 132,000 tons of soybeans to China for 2021-22 delivery.

· South Korea’s Agro-Fisheries & Food Trade Corp. bought about 3,700 tons of non-GMO soybeans at $1,056/ton c&f for arrival between Oct. 20 and Nov. 19.

USDA Attaché: Argentina biofuels annual

Updated 8/24/21

September soybeans are seen in a $12.75-$13.50 range; November $11.75-$15.00

September soybean meal – $345-$370; December $320-$425

September soybean oil – 59-64; December 48-67 cent range

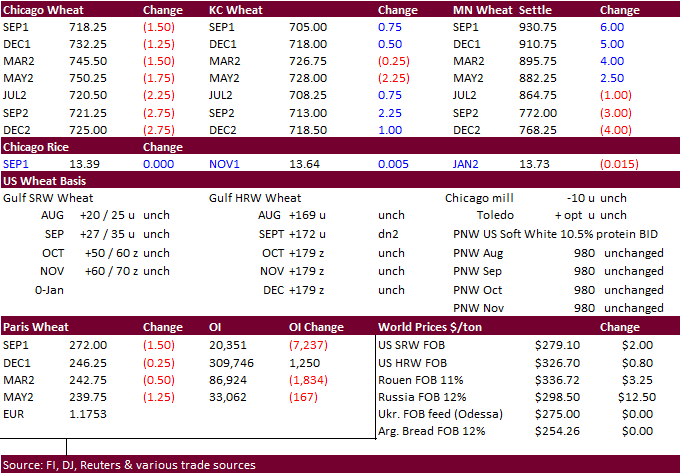

· US wheat and EU wheat opened lower on north American harvest pressure. US markets turned higher and traded lower/higher on multiple occasions. Chicago ended lower, KC mixed and Minneapolis mixed/higher. Parris wheat ended 0.25 lower for the December contract and September was down 1.50 euros. Paris Many parts of the EU are done with harvesting.

· Funds sold an estimated net 3,000 Chicago wheat contracts.

· Agritel: French soft wheat crop was estimated at 34.93 million tons, well below 36.69 million tons projected by the French AgMin earlier this month. Some traders were looking for a 38-million-ton crop earlier this season. Nearly all the soft wheat crop had been harvested.

· The USD was 7 points lower as of 2 pm CT.

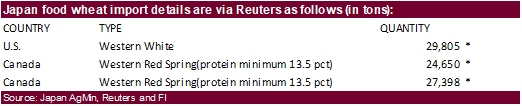

· Japan seeks 81,853 tons of food wheat from the US and Canada.

· Results awaited: Pakistan received offers for 400,000 tons of wheat for Sep/Oct shipment. Lowest was $355.99/ton.

· Results awaited: Morocco seeks 363,000 tons of US durum wheat under a tariff import quota for shipment by December 31.

· Jordan seeks wheat on Aug 25.

· Jordan seeks 120,000 tons of feed barley on August 26.

· Bangladesh seeks 50,000 tons wheat on September 1.

· Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

Rice/Other

- Egypt seeks 200,000 tons of raw sugar for Oct-Dec shipment on August 28.

Updated 8/17/21

December Chicago wheat is seen in a $6.80‐$8.25 range

December KC wheat is seen in a $6.60‐$8.00

December MN wheat is seen in a $8.45‐$9.80

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.