PDF attached

USDA

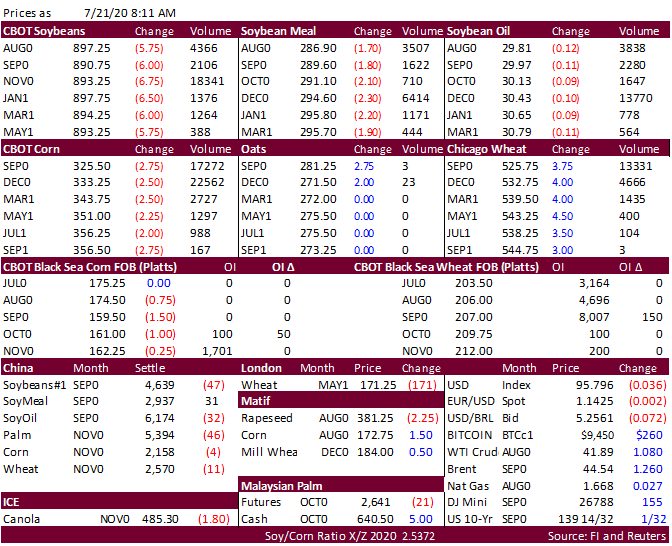

announced another 5 cargoes of soybeans sold to China and unknow and 207,880 tons of corn (old and new) for unknown. Lower trade led by soybeans this morning on bearish US crop progress. US corn and spring wheat crop conditions were unchanged. Soybean conditions

increased one point. Offshore values are pointing towards a lower trade in SBO and SBM. Malaysia palm traded 20 MRY lower after hitting fresh 5-month highs overnight. SA soybean oil cash prices were said to be down 10-15 USD from Friday into Monday, according

to one source. Corn is lower good weather. South Korea’s NOFI group bought wheat and corn. US wheat prices are higher on global demand. Egypt is in for wheat. The Philippines seek 110,000 tons of feed wheat. Jordan saw two participants for 120k wheat.

Ethiopia postponed their import tender. Taiwan seeks US wheat. USD lower this morning while WTI was up more than $1.30. The euro climbed to its highest in more than four months against the dollar.