Lots of bearish themes this morning including: Freeport, yesterday’s storage report and the upcoming one, and this morning weather run.

Lets start with the latest from Freeport:

- The facility announced it has delayed its restart target until the end of the year, about two weeks beyond its previous estimate, as it works with US regulators to secure all approvals necessary to resume production.

- The operator said that the facility continues to progress through repairs and is “collaborating closely” with regulatory agencies in order to obtain necessary approvals to restart production.

- Freeport LNG on December 1 has received several key approvals from regulatory agencies to allow for the restart of “certain systems” but did not specify which parts of the facility were approved.

- The facility has also indicated that the ramp would be slow with one train coming on at a time. So we are probably looking at a late-Jan timeframe for all 3 trains to be active.

- Freeport LNG must receive regulatory approvals from the Department of Transportation (DOT)’s Pipeline and Hazardous Materials and Safety Administration (PHMSA) and the Federal Energy Regulatory Commission (FERC), as well as other agencies, before resuming production.

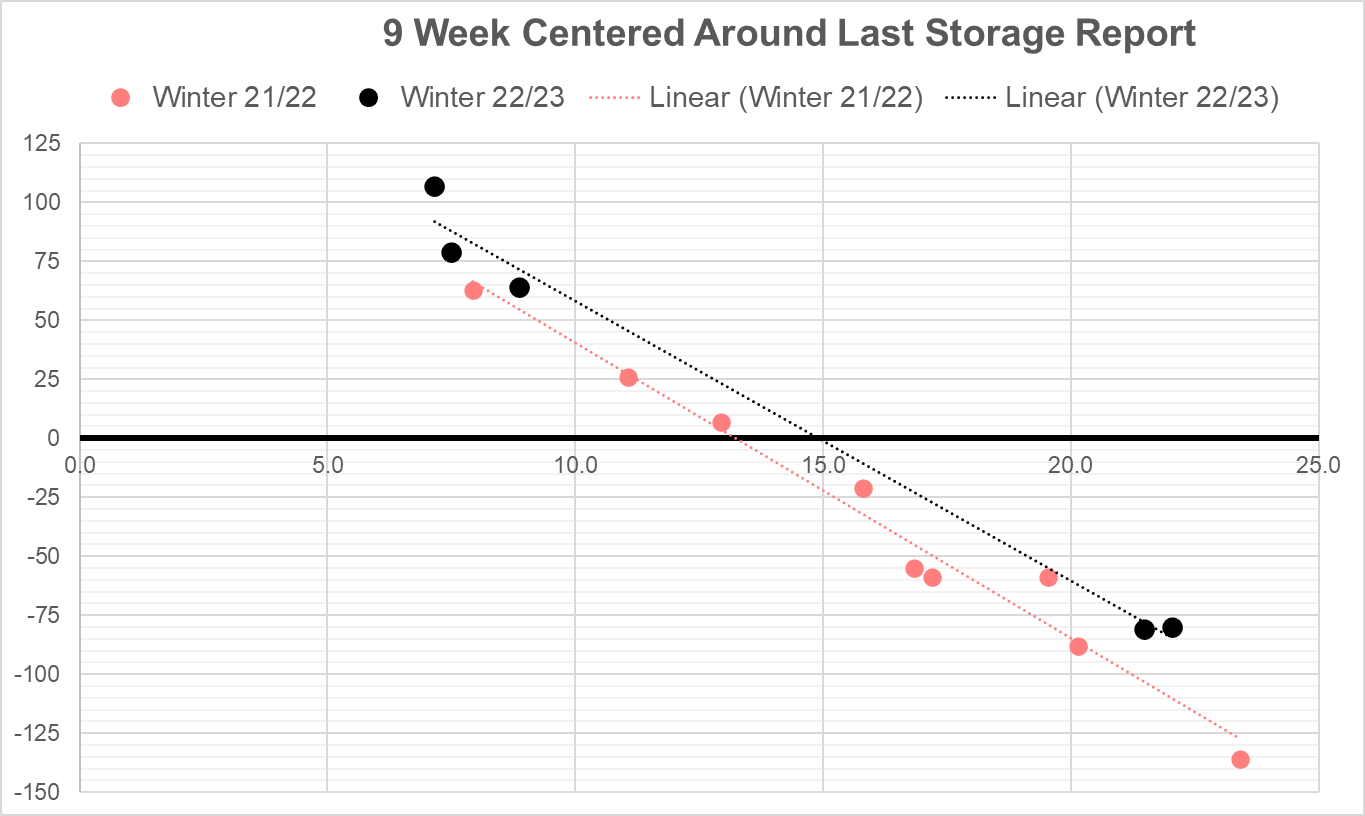

Now lets look at yesterday’s EIA storage report. The EIA reported a -81 Bcf draw for the week ending November 25th, which landed right on the estimate from our S/D model. Our flow model indicated a -78 Bcf draw, which was also on the right side of market consensus. This storage report takes the total level to 3483 Bcf, which is -89 Bcf below last year at this time and -86 Bcf below the five-year average of 3,569 Bcf.

This was somewhat of a tricky week with the thanksgiving holiday planted close the week off. On Friday, we saw an extremely wide range for this report.

This past report continues to be loose relative to LY. We peg this report at being +3.1 Bcf/d loose (wx-adjusted).

Our view storage outlook for the upcoming report is -10 Bcf today.

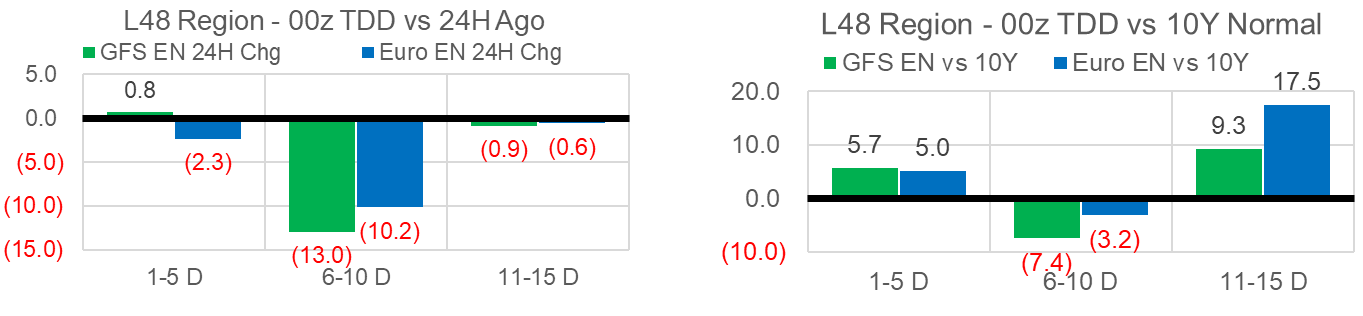

Finally, lets cover the bearish change in temps in this morning’s 00z runs. The 6-10 day period was significantly warmer from both major models.

Today’s Fundamentals

Daily US natural gas production is estimated to be 100.3 Bcf/d this morning. Today’s estimated production is -0.78 Bcf/d to yesterday, and -0.84 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 96.6 Bcf today, -10.86 Bcf/d to yesterday, and +4.82 Bcf/d to the 7D average. US power burns are expected to be 28.9 Bcf today, and US ResComm usage is expected to be 33.8 Bcf.

Net LNG deliveries are expected to be 12.4 Bcf today.

Mexican exports are expected to be 6.2 Bcf today, and net Canadian imports are expected to be 5.3 Bcf today.

The storage outlook for the upcoming report is -10 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.